Streamlining Business Operations with HRM & Payroll

Contact Us

HRM & Payroll are critical for staying compliant with labor laws, tax regulations, and employment standards. Staying compliant avoids hefty fines and penalties.

Efficient HRM fosters a positive work environment and supports employee satisfaction. When payroll processes are error-free and timely, it adds to this satisfaction.

Proper HRM ensures that the right people are in the right roles, optimizing resource allocation. Efficient payroll management reduces the cost of errors and time spent correcting them.

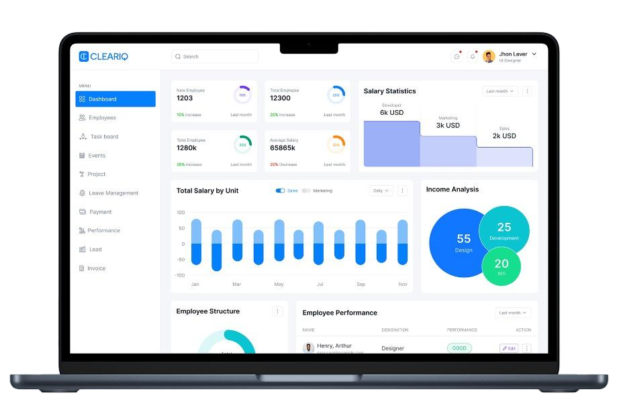

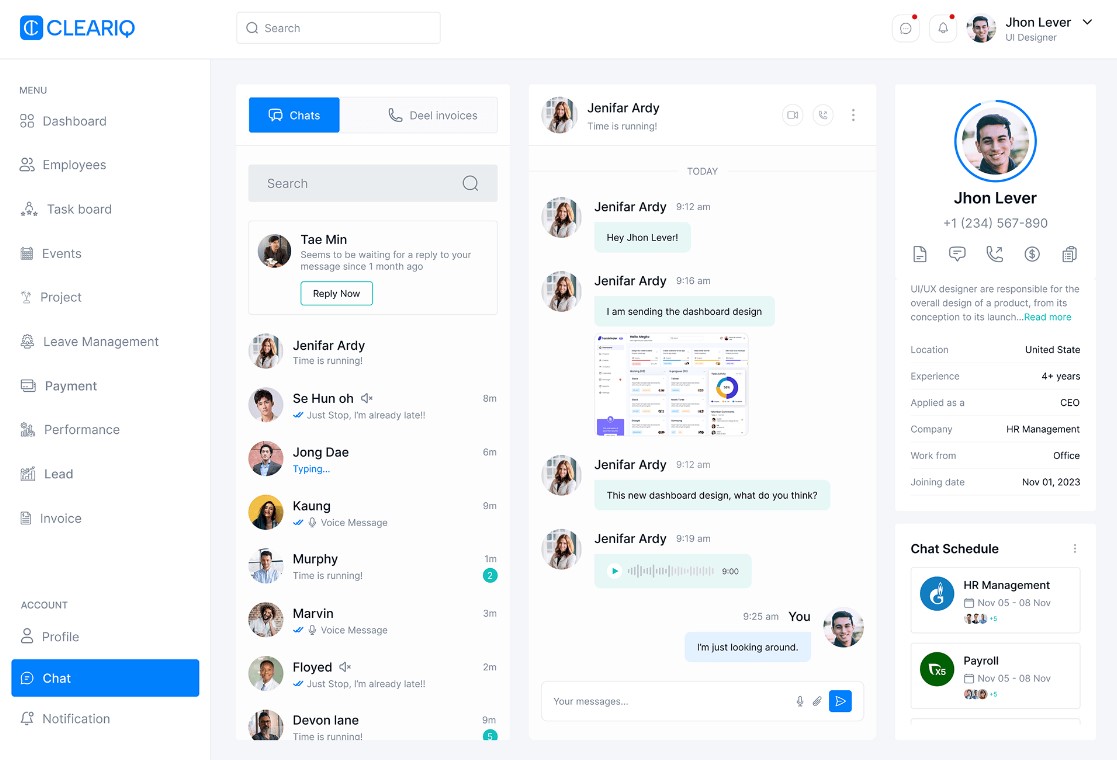

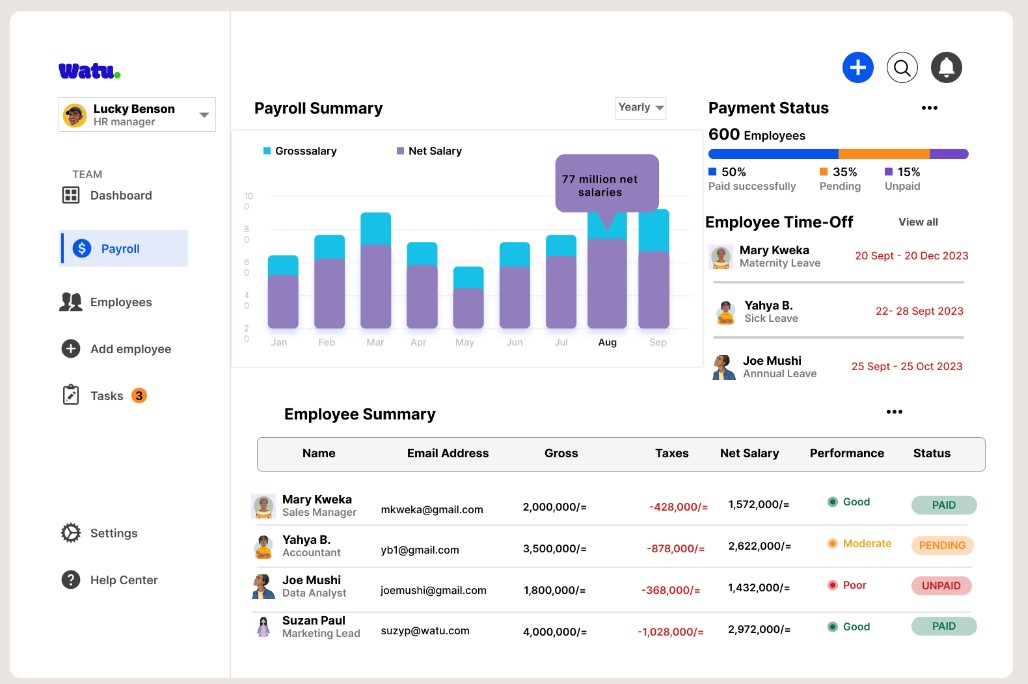

HRM systems maintain employee data, including personal information, salaries, and deductions. This data is crucial for accurate payroll processing.

HRM systems track attendance and time-off requests. This information directly impacts payroll calculations.

HRM manages the hiring and termination process, which must be seamlessly integrated into the payroll system to ensure accurate pay and tax calculations.

Choose a modern HRM system that can handle the full employee lifecycle, from recruitment to retirement. Ensure your system is scalable to accommodate growth. Automate routine HR tasks, like leave management and employee self-service portals.

Invest in a payroll software that can handle complex calculations, tax compliance, and multiple pay schedules. Ensure it integrates seamlessly with your HRM system to minimize data entry and reduce errors.

Provide training for HR and payroll staff to ensure they are proficient in using the systems. Stay updated with changes in labor laws and tax regulations to maintain compliance.

HRM & Payroll are critical for staying compliant with labor laws, tax regulations, and employment standards. Staying compliant avoids hefty fines and penalties.

Utilize the data collected by HRM and Payroll systems for insightful reporting and analytics to make data-driven decisions.